When you're ready to buy something online, what's your go-to payment method? Most of us reach for a familiar credit or debit card, a speedy digital wallet like PayPal or Apple Pay, or maybe even a flexible Buy Now Pay Later plan. These are the big three, offering a blend of convenience, security, and speed that covers just about every shopping scenario.

The New Era of Online Checkout

Remember the bad old days? You’d finally find what you wanted online, only to spend the next five minutes frantically digging for your wallet and squinting to type in that sixteen-digit card number. Thankfully, those days are over. We’re in a new age of paying online, where a single click, tap, or even a quick glance is all it takes to complete a purchase.

This isn't just a minor upgrade; it has completely changed the game for e-commerce. The final step of buying something is now just as important as the product you're buying.

A clunky, slow, or sketchy-looking checkout is an instant deal-breaker. It's the digital equivalent of a long, slow line at a physical store. In fact, a whopping 45% of shoppers admit to ditching their cart simply because their favorite way to pay wasn't an option or the system was buggy.

Why Your Payment Choice Matters

Think of all the different payment options as a toolkit. You wouldn't use a sledgehammer to hang a picture frame, right? Each payment method is a specific tool designed for a different job, with its own set of perks. Getting to know this toolkit is the secret to becoming a smarter, safer online shopper. This guide is your map.

Here’s a quick rundown of why having plenty of payment methods is a must-have in today's online world:

- Top-Notch Security: Modern payment options are packed with serious security tech, like tokenization and biometrics, to keep your financial info locked down tight.

- Warp-Speed Checkout: Digital wallets and saved card details can turn a checkout process that used to take minutes into a matter of seconds. In the fast-paced world of online deals, every second counts.

- Budgeting on the Fly: Services like Buy Now, Pay Later give you the power to spread the cost of a big purchase over time, often with no interest. It's a great way to manage your cash flow without missing out.

- A Better Shopping Vibe: A smooth payment process is the cherry on top of a great shopping experience. It's what keeps customers happy and coming back for more.

The online checkout is the final handshake between you and a brand. When it's seamless and secure, it doesn't just close a sale—it builds trust and makes you want to shop there again.

Consider this your personal tour of the most popular ways to pay. We'll dive into the old reliables like credit cards, the game-changers like digital wallets, and those handy financing services. Once you understand the pros and cons of each, you'll be shopping with more confidence and security, whether you're weighing the differences between online shopping vs in-store shopping or just snagging a quick bargain.

How Digital Wallets Are Winning the Checkout Race

Let's be honest: digital wallets are the undisputed champs of the modern checkout, and for good reason. Imagine a world where you never have to fish a physical card out of your wallet again. That's the magic of services like PayPal, Apple Pay, and Google Pay. They’ve completely changed the game for online shopping by delivering a one-two punch of speed and security that old-school methods just can't keep up with.

Think of a digital wallet as your own personal, highly secure financial assistant. Instead of handing your credit card details to every single online store you shop at, you entrust them just once to your wallet provider. When you click "buy," your assistant steps in and handles the transaction using a special, one-time-use code. Your real card details are never exposed to the merchant.

This clever process is called tokenization, and it's the secret sauce behind their rock-solid security. It dramatically slashes the risk of your info getting swiped in a data breach. If a hacker hits a store you bought from, all they get is a useless, expired token—not your actual card number.

The Need for Speed and Simplicity

Security is great, but let's talk about the real reason these wallets are so popular: pure, unadulterated convenience. In a world of one-click everything, nobody has the patience to manually punch in a 16-digit card number, expiration date, and CVV every single time they want to buy something.

Digital wallets kill that friction dead. Once you’re set up, checking out becomes as simple as a thumbprint, a quick facial scan, or tapping in a passcode. It transforms a tedious chore into a single, satisfying tap, which is a total game-changer on mobile where typing is a pain.

And the numbers don't lie. Digital wallets now drive a staggering 53% of all online purchases globally, a figure that’s on track to hit 65% by 2030. Here in the U.S., they already account for nearly 39% of online transactions. PayPal is the clear leader of the pack, with an incredible 71% penetration rate among American adults. If you want to dive deeper into the data, you can explore more about current consumer trends.

Digital wallets are no longer just a cool alternative; they are the new standard for paying online. Their blend of biometric security and one-click convenience has raised the bar for everyone else.

Choosing Your Digital Champion

While they all work on the same basic principle, not all digital wallets are created equal. Each of the big players brings something a little different to the table, usually tailored to a specific type of device or user. Figuring out these nuances can help you pick the perfect one for how you shop.

Here’s a quick rundown of the heavyweights:

- PayPal: The OG of online payments. PayPal is the universal soldier—it works on almost any device or browser. Its biggest advantage is that practically every online store on the planet accepts it. Plus, its buyer protection policies are top-notch, giving you a safety net if a purchase goes sideways.

- Apple Pay: If you live and breathe the Apple ecosystem (iPhone, Mac, Apple Watch), this is your guy. Apple Pay uses the slick biometrics already built into your device, like Face ID or Touch ID, making it unbelievably fast and secure. The only catch? It's an Apple-only club.

- Google Pay: This is essentially the Android version of Apple Pay. Google Pay comes pre-loaded on most Android phones and works seamlessly in apps and on websites via the Chrome browser. It offers the same tokenized, biometric-secured goodness, making it the natural choice for the millions of non-Apple users out there.

- Amazon Pay: For the die-hard Amazon shopper, Amazon Pay is a dream. It lets you use your saved Amazon account info to breeze through checkout on thousands of other websites. The appeal is simple: no more creating new accounts or re-entering your card details all over the web.

In the end, your choice will probably come down to the phone in your pocket and your favorite online stores. But one thing is certain: adding a digital wallet to your shopping routine is one of the smartest (and safest) moves you can make online today.

More Ways to Pay Than You Can Shake a Stick At

While digital wallets seem to be getting all the love these days, the world of online payments is a full-blown circus, not a one-act show. There's a whole cast of other characters, each with its own special trick. Think of it like a toolbox—you wouldn't use a sledgehammer to hang a picture frame, right? This is your grand tour of the entire toolkit.

We'll kick things off with the old reliables: credit and debit cards. They're the foundation of all this. Then, we'll dive into the trendy "Buy Now, Pay Later" options that are totally changing how we budget for big-ticket items. We'll even get into the nitty-gritty of direct bank transfers and dip our toes into the wild west of cryptocurrency.

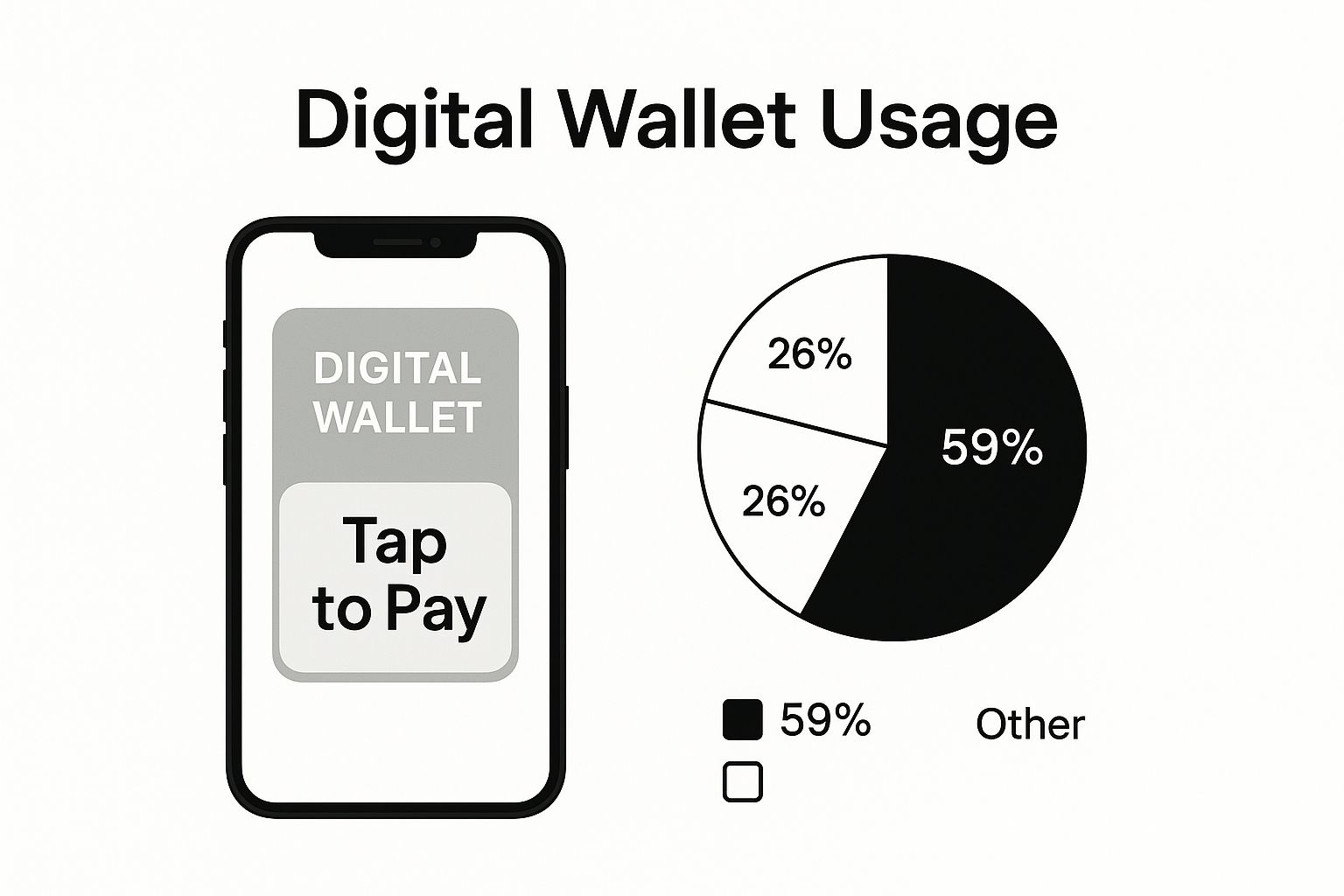

This image really drives home just how much our phones have become the center of our shopping universe.

You can see the clear trend: we're moving away from physical cash and cards and toward slick, integrated digital options that live right in our pockets.

The Timeless Power of Credit and Debit Cards

Even with all the shiny new toys on the market, good old-fashioned plastic is still king. Credit and debit cards are the bedrock of online shopping, and for good reason. They're accepted almost everywhere, we all know how to use them, and they’re backed by decades of security. In fact, a recent study found that 63% of people still prefer using a credit or debit card when they shop online.

Credit cards are essentially tiny, on-demand loans. You're borrowing the bank's money for a purchase and promising to pay it back. This makes them perfect for scoring rewards like cashback or airline miles and for handling larger purchases you might want to pay off over time.

Debit cards are the opposite—they pull money directly from your checking account. No borrowing, no debt. They're the ultimate tool for staying on budget and making sure you never spend more than you actually have.

The real superpower of credit cards, though, is their incredible fraud protection. If someone steals your info or a shady seller rips you off, federal law usually caps your liability at just $50. Most major banks go even further with zero-liability policies.

Buy Now, Pay Later: The Budgeting Game Changer

Ever find that must-have item but your wallet says, "Maybe next month"? That's where Buy Now, Pay Later (BNPL) swoops in to save the day. Services like Klarna, Affirm, and Afterpay are the modern, cooler version of the old layaway plan—but you get your stuff right away.

It's simple. BNPL splits your purchase into a handful of smaller, interest-free payments. That $200 jacket? It can become four easy payments of $50. This flexibility has made it a massive hit, especially with younger shoppers. In the UK, around 42% of adults have given a BNPL service a try, which shows you just how mainstream it’s become.

A word of caution, though: you have to be smart about it. Miss a payment, and you could get hit with late fees that might ding your credit score. Always make sure the payment plan fits your budget before you click "confirm."

The Understated Reliability of Bank Transfers

Sometimes, the simplest path is the best one. Direct bank transfers, often called ACH transfers, let you move money straight from your bank account to the seller's. By cutting out the middlemen (like Visa or Mastercard), merchants can often save on fees.

While you probably won't use a bank transfer to buy a coffee, it's the go-to payment method in a few key situations:

- Big-Ticket Items: Buying a couch or a fancy TV? A direct transfer can be way more secure than whipping out a credit card with a spending limit.

- Paying Bills: This is the standard for recurring payments like rent, utilities, and subscriptions where you just want to set it and forget it.

- Business-to-Business: Companies use bank transfers all the time to pay suppliers and handle large invoices because they're reliable and cost-effective for big sums.

Cryptocurrency: The New Frontier of Payments

The payment world is moving at lightning speed. There are now roughly 5.6 billion digital wallet users worldwide, and mobile payments account for a whopping 48% of daily purchases. In this whirlwind of change, cryptocurrencies like Bitcoin and Ethereum are starting to carve out their own space. It's still a niche, but it's growing fast—16% of online retailers now accept crypto, up from just 5% two years ago. For more fascinating stats, check out this deep dive on online payment evolution from CoinLaw.io.

Paying with crypto is like using digital cash that no single bank or government controls. It's built on a public ledger called the blockchain, offering a unique blend of transparency and privacy since your personal identity isn't directly attached to the transaction.

Of course, it’s not all smooth sailing. Crypto values can swing wildly, and the process can feel a bit clunky for beginners. But for people who prize privacy and are comfortable with the tech, it’s a glimpse into what the future of online commerce might look like.

Comparing Popular Online Payment Methods

Feeling a bit overwhelmed? Don't be. Each payment method has its moment to shine. Here’s a quick-glance table to help you figure out which tool is right for the job.

| Payment Method | Best For | Key Advantage | Potential Drawback |

|---|---|---|---|

| Credit Cards | Everyday purchases, travel, earning rewards | Robust fraud protection & purchase rewards | Risk of accumulating debt and interest fees |

| Debit Cards | Daily spending, budget management | Direct access to funds; no debt risk | Limited fraud protection vs. credit cards |

| Digital Wallets | Fast, convenient mobile & in-app checkouts | Speed, security (tokenization), convenience | Not all merchants accept every type of wallet |

| Buy Now, Pay Later | Spreading the cost of larger purchases | Instant gratification with installment payments | Late fees and potential impact on credit score |

| Bank Transfers | Large transactions, recurring bills, B2B | Low fees for large sums, high security | Slower processing times, not ideal for instant buys |

| Cryptocurrency | Privacy-focused users, international payments | Decentralized, low cross-border fees, user anonymity | High price volatility and complex to use |

Ultimately, the "best" payment method really depends on what you're buying, where you're shopping, and what you value most—be it convenience, security, or budgeting power.

How to Keep Your Payments Safe and Secure

The magic of buying anything you want online comes with a side of responsibility. You have to be smart about your security. Think of your financial info like the keys to your house—you wouldn't just hand them out to strangers, right? This is your no-fluff guide to dodging digital pickpockets and making sure every click-to-buy is a safe one.

Let's pull back the curtain on some of the tech working to protect you. First up is a clever trick called tokenization. Instead of your real credit card number flying across the internet, the merchant gets a unique, one-time-use secret code—a token. If a hacker ever breaks in, all they find is a pile of useless, expired tokens. It’s like a Mission: Impossible message that self-destructs after being read.

Your Personal Security Checklist

You don't need a degree in cybersecurity to stay safe. It's all about building a few simple, powerful habits. Each one is another lock on the door, making it a massive headache for anyone trying to get in.

Here’s how to lock down your online payments:

- Look for the Lock: Before you even think about typing in your card details, glance up at the website's address bar. You want to see "https://" and a little padlock icon. That 's' is the important part—it means the connection is encrypted, scrambling your data into gibberish that snoops can't decipher.

- Create Unbreakable Passwords: Seriously, it's time to retire "Password123." A truly strong password is long (at least 12 characters) and a jumble of upper and lowercase letters, numbers, and symbols. A good password manager is your best friend here, creating and remembering ridiculously complex passwords so you don't have to.

- Spot Phishing Scams: Get skeptical about those urgent emails or texts demanding you "verify your account" or "claim your prize." They're usually traps (phishing scams) to steal your logins. When in doubt, ignore the link and go directly to the company's official website yourself.

Want to dive deeper? We've got a whole list of essential tips for safe online shopping that covers everything from the dangers of public Wi-Fi to sniffing out fake reviews.

The Power of Two-Factor Authentication

If you do just one thing from this entire guide, make it this: turn on Two-Factor Authentication (2FA) wherever it’s offered. It’s like needing two separate keys to unlock a vault. Your password is the first key. The second is a temporary code that gets sent to your phone.

So, even if a crook manages to steal your password, they're stuck. Without that second key from your phone, they can't get in. This one simple step is proven to block 99.9% of automated cyberattacks, making it your single most powerful defense.

Think of 2FA as a digital bouncer for your online accounts. It doesn't just check for a key; it checks your ID at the door to make sure the real you is the one trying to get in.

How Merchants Protect You

Security isn't just on you; it's a team sport. Good online stores invest a ton of money and effort into protecting their customers. They’re the digital sentinels standing guard. For starters, there’s something called PCI compliance, a rigorous set of security rules that any business handling card payments has to follow. It’s a baseline guarantee that your data is being stored and managed in a secure bunker.

On top of that, many retailers use AI-powered fraud detection. These brainy systems watch thousands of data points in real-time—your location, how much you're spending, your usual shopping habits—to spot anything that looks fishy. If a purchase seems way out of character, the system can instantly flag or block it, stopping fraud in its tracks. Knowing these protections are in place lets you shop with confidence, because you're not in it alone.

Choosing the Right Payment Mix for an Online Store

For anyone running an online store, the checkout page isn't just the end of the line—it's the grand finale. The mix of payment methods you offer is like curating the perfect menu for a restaurant. Get it right, and customers leave happy and come back for more.

Get it wrong, and they might walk out before even tasting the food, leaving a trail of abandoned carts behind.

Think of it this way: offering only one or two payment options is like a food truck that only sells vanilla ice cream. Sure, some people love vanilla, but you're missing out on everyone who prefers chocolate, strawberry, or something more exotic. Your payment mix needs to cater to your unique audience's tastes.

This isn't just about adding more buttons to your checkout page; it's a strategic decision that directly fuels your sales engine. A smooth, trustworthy, and flexible payment process can dramatically reduce cart abandonment and turn hesitant shoppers into loyal customers.

Know Your Customer, Know Your Payments

The first step in building your payment 'menu' is to become a detective. You need to really dig in and understand who your customers are and how they actually prefer to pay. One size definitely does not fit all in the world of e-commerce.

Are you selling trendy apparel to Gen Z? Then offering Buy Now, Pay Later (BNPL) options like Afterpay or Klarna isn't just a nice-to-have; it's an absolute must. This demographic practically lives on financial flexibility and is completely comfortable with installment-based payments.

On the other hand, if your store attracts a global audience, you need to think beyond the usual suspects. Your payment options should reflect what’s popular in different regions. For example, customers in some parts of Europe might prefer direct bank transfers, while shoppers in Asia may gravitate towards specific regional digital wallets. Analyzing your sales data by location will show you exactly which payment methods for online shopping are essential for international growth.

The perfect payment mix isn’t about offering every option under the sun. It's about offering the right options that make your specific target customer feel understood, secure, and ready to click 'buy'.

The Business Side of Payments

Beyond what your customers want, you have to weigh the practical business considerations. Every payment method comes with its own set of rules, costs, and technical quirks.

Here are the key factors you need to balance:

- Transaction Fees: Payment processors take a slice of every sale, usually a small percentage plus a fixed amount. These can nibble away at your profit margins, so comparing rates is non-negotiable.

- Ease of Integration: How easily can a new payment option be bolted onto your existing e-commerce platform? Some are plug-and-play, while others might require some serious technical heavy lifting.

- Mobile Experience: A massive chunk of online shopping happens on smartphones, so your checkout process has to be flawlessly mobile-friendly. Clunky forms and tiny buttons are conversion killers.

The payments industry has seen explosive growth, completely reshaping how we all do business. Digital payment volumes soared to an incredible $18.7 trillion in 2024, a massive leap from just $1.7 trillion a decade earlier. Today, digital payments make up 66% of e-commerce transaction values globally, which just goes to show how critical it is for merchants to keep up.

If you're building an e-commerce presence, understanding how to launch an online marketplace in Australia with the right payment setup is a great place to start.

Ultimately, your goal is to strike that perfect balance between giving customers the choices they want and managing the costs and complexity for your business. By carefully analyzing your audience and weighing the operational trade-offs, you can turn your payment page from a potential roadblock into your most powerful conversion tool.

Your Burning Questions About Online Payments, Answered

Let's be honest, the world of online payments can sometimes feel like trying to solve a Rubik's Cube in the dark. To shed some light, here are the real answers to the questions we all have, so you can click "buy" with total confidence.

What’s Genuinely the Safest Way to Pay for Stuff Online?

When it comes to staying safe, credit cards and major e-wallets like PayPal are your best friends. Think of your credit card as a financial bodyguard. Thanks to some pretty robust fraud protection laws, you're almost never on the hook for shady charges if your card details get swiped.

E-wallets take it a step further. They use a clever trick called tokenization, which is basically a secret code for your card info. Your real card number never even gets sent to the seller, which seriously slashes the risk of it getting exposed if they ever have a data breach.

Are Those "Buy Now, Pay Later" Things Actually a Good Idea?

Buy Now, Pay Later (BNPL) can be an absolute lifesaver for managing your budget, especially when you've got your eye on something big. It lets you slice up the cost into smaller, usually interest-free payments. You get your goodies right away without the immediate hit to your bank account—it's like layaway, but instant and way cooler.

But, like any powerful tool, you've got to use it wisely.

BNPL is fantastic for cash flow, but always think of it as a small, short-term loan. If you miss a payment, you could get hit with late fees, and it might even ding your credit score. Just make sure you can handle the payments before you commit.

Why Do Some Stores Have a Million Payment Options and Others Just a Few?

Ever get to a checkout and wonder why one place takes Apple Pay but the next one doesn't? It all comes down to a behind-the-scenes business juggle. A few key factors are at play:

- Pesky Transaction Fees: Every payment method charges the store a little slice of the pie. Some slices are bigger than others.

- Knowing Their Audience: A shop aimed at Gen Z is definitely going to offer BNPL and digital wallets, while a different store might not bother.

- The Tech Headaches: Believe it or not, plugging some payment systems into a website can be a real pain.

So, a small boutique might ditch a certain credit card to save on fees, whereas a massive global brand will bend over backwards to offer local payment methods for their international shoppers.

Can I Really Buy a T-Shirt with Bitcoin?

Yep, you absolutely can—but it's still a bit of a frontier town out there. A growing number of online shops are dipping their toes into the crypto waters and accepting currencies like Bitcoin. The big appeal is that it's decentralized and more private, since your name isn't directly attached to the transaction.

Just be warned: the value of crypto can swing wildly, and the checkout process isn't always as smooth as whipping out your Visa. It’s definitely a niche corner of the online payment world, but it's one that's getting bigger every day.

Ready to put all this newfound payment wisdom to use? Over at AMI Cart, we keep things simple and secure with options like PayPal and all major credit cards. Go find your next favorite thing in our latest collections!